does betterment provide tax documents

Only dividends and realized gains will have tax due. Betterment does offer tax-loss harvesting automatically.

This Calendar Breaks Down Everything You Need To Do For Your Taxes In 2015 Tax Season Season Calendar Tax Help

If you have wash sales it gets more complicated since those adjusted transactions have to be itemized on Form 8949 and the summary totals adjusted accordingly.

. With Betterment you can automatically import your tax information into TurboTax. Betterment will send you. You will not receive a 1099-R for a direct trustee-to-trustee transfer from.

Betterment Digital provides automated portfolio management and charges 025 annually. Every tax year Betterment will generate and make available to you the required 1099-B and 1099-DIV tax forms for the TIN or SSN of the trust. You have to enter them on your tax return.

If you have a personal and trust account. A betterment is a specific type of project performed by a government entity that improves a specific area. Tax loss harvesting TLH works by using investment losses to.

Betterment keeps track for you and provides all the tax documents you need. Dividends will always be taxed so you need to break down your profit into dividends realized and unrealized gains. Somewhat pricey financial advisor consultations.

Betterment does provide Form 5498 to its members as long as they have made the IRA contributions made conversions as well as rollovers in their retirement accounts on the platform. Betterment also offers tax-loss. Betterment has calculated this for you based on your state of residence listed within your account.

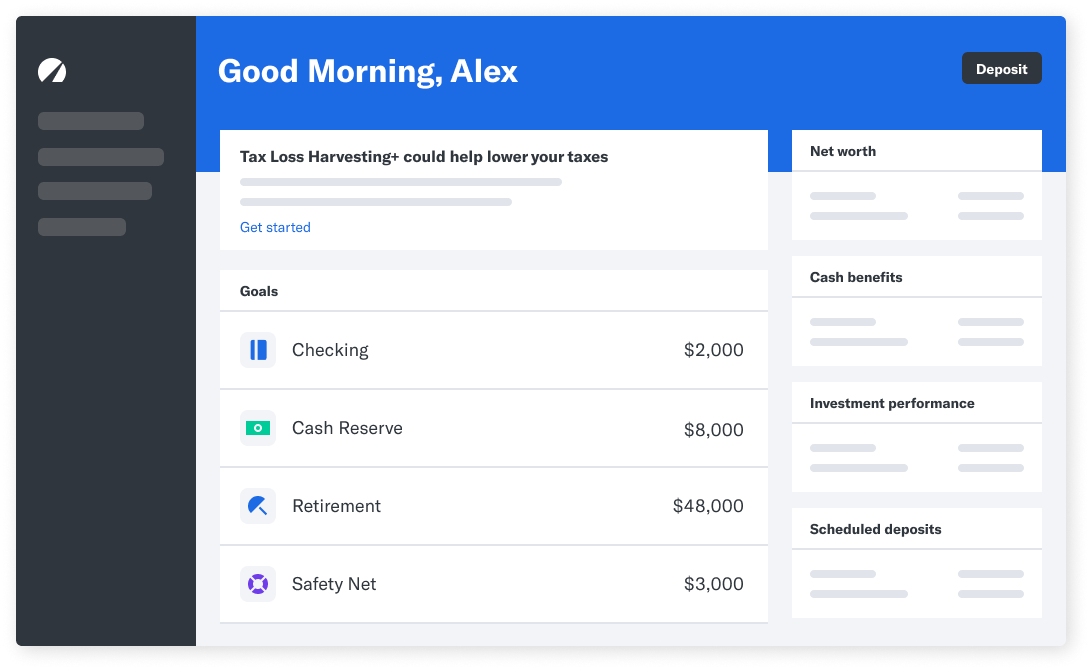

15 is the deadline for Betterment to provide Form 1099-BDIV which reports investment sales and dividends received in a taxable investment account. Betterment LLCs internet-based advisory services are designed to assist clients in achieving discrete financial goals. Simply head to the Documents section of your account and then click the Tax Forms.

This potentially limits some upside during tax-harvesting. Reporting Betterment Tax Form. The soonest you can start importing is Feb.

Does betterment provide tax documents Saturday March 12 2022 Edit. Betterments tax-coordinated portfolio adds a lot of value for taxable accounts. View tax forms statements and other documents.

Betterment is a clear leader among robo-advisors offering two service options. Read More May 31. A betterment is a specific type of project performed by a government entity that improves a specific area.

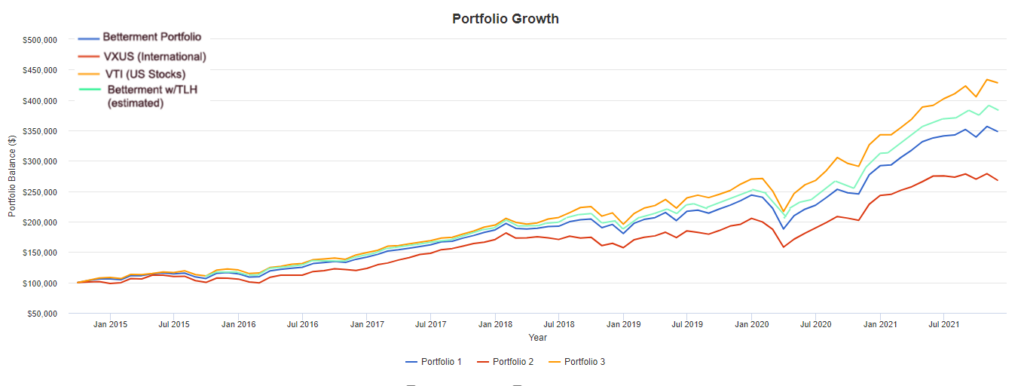

Choose from Broad Impact Social Impact and Climate Impact portfolios. Betterment estimates annual savings of 048 or 15 over 30 years. Betterments tax strategy is just fine but rival Wealthfront is among the robo-advisors with a more sophisticated tax strategy.

Report Inappropriate Content. For example if you click. Every tax year Betterment will generate and make available to you the required 1099-B and 1099-DIV tax forms for the TIN or SSN of the trust.

Tax-loss harvesting has been shown to boost after. Ad Align your values and investments with Betterments upgraded SRI portfolios. They are not intended to provide comprehensive tax advice.

Choose from Broad Impact Social Impact and Climate Impact portfolios. You should be able to go to the Documents section within Betterment and print your quarterly statements to at least know your exposure to short-term gains and associated taxes. Betterment provides automatic tax loss harvesting to all investors at no extra cost for Taxable accounts only.

Usually various robo-advisors use ETFs. Projects that qualify as improvements will depend on the taxing. When importing tax forms you will be able to deselect certain tax.

Note that we do not currently support integration with. We may also provide you with a Supplemental Tax Form that calculates key tax information for. Edit your portfolio strategy.

Betterment LLCs internet-based advisory services are designed to assist clients in achieving discrete financial goals. Under Documents you can find your statements tax documents and other documents which can be extremely helpful in terms of tax planning. Ad Align your values and investments with Betterments upgraded SRI portfolios.

It is unfortunate that betterment does not have direct indexing in its users portfolios. The forms 1099-B reports your sales of stocks in 2021. Betterment increases after-tax returns by a combination of tax-advantaged strategies.

They are not intended to provide comprehensive tax advice or financial. Betterment Taxes Summary.

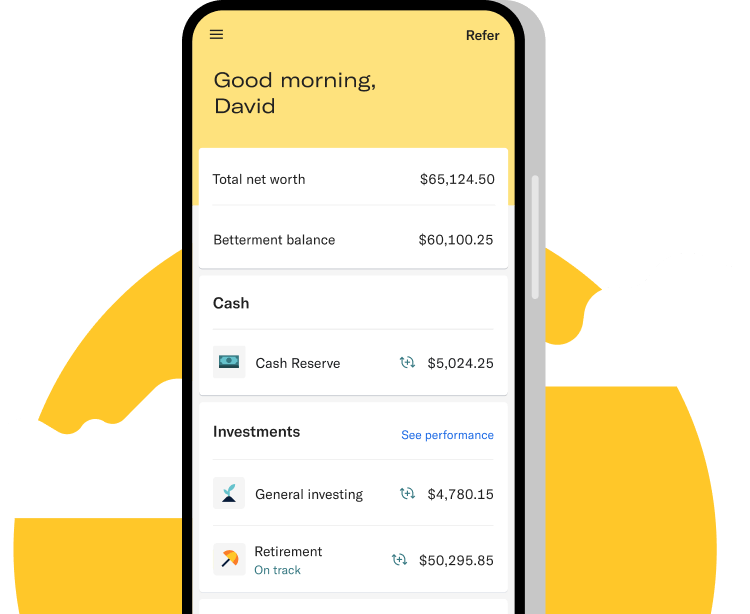

Betterment Mobile App Investing On The Go

Betterment Review Smartasset Com Cash Management Retirement Retirement Accounts

Betterment Taxes Explained 2022 How Are Investment Taxes Handled

Betterment Survey Sees Rising Interest In Socially Responsible Investing More Room For Education

Betterment Sophisticated Online Financial Advice And Investment Management Investing Saving App Investment Tools

The Betterment Experiment Results Mr Money Mustache

6 Tax Strategies That Will Have You Planning Ahead

Betterment Review Automated Financial Investment Robo Advisor Investing Financial Investments Portfolio Management

Retirement Advice Retirement Calculator Investing For Retirement

Tax Smart Investing With Betterment

/wealthsimple-vs-betterment-1c84228732c642fe91a5844e25b18589.jpg)

Wealthsimple Vs Betterment Which Is Best For You

Tax Smart Investing With Betterment

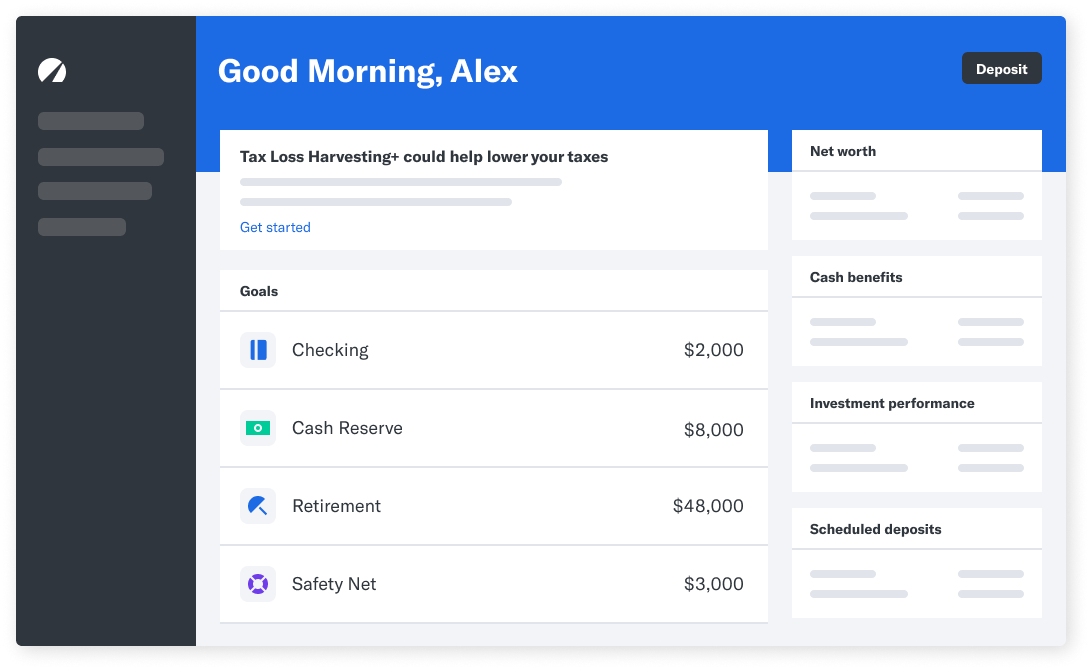

Using Investment Goals At Betterment

A Beginner Investors Guide To Vanguard And Betterment Two Quality Low Cost Investment Providers So You Can Deter Finance Investing Investing Investing Money

Why Has Betterment Frozen Checking Account Applications Forbes Advisor

/betterment_new_logomark-color-486b823c00444745b726163af424e476.png)